First food: business of taste

Good Food is First Food. It is not junk food. It is the food that connects nature and nutrition with livelihoods. This food is good for our health; it comes from the rich biodiversity of our regions; it

Good Food is First Food. It is not junk food. It is the food that connects nature and nutrition with livelihoods. This food is good for our health; it comes from the rich biodiversity of our regions; it

Caffeine in soft drinks linked to high blood pressure

Chicken laced with arsenic

Pesticides can affect the cells

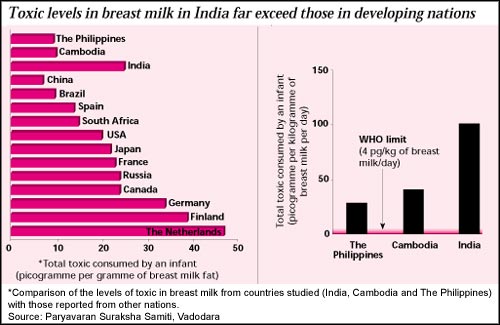

After finding high levels of dioxin related compounds in breast milk of women living near landfills, a Vadodara based non governmental organisation intends to file a public interest litigation PIL against the Gujarat Pollution Control Board and the Vado

toxic pool: The Local Area Environment Committee (LAEC) recently termed the Eloor and Edayar indus trial belt in Kochi, Kerala, a "toxic hot spot' filled with heavy metals and pesticides.

calling trouble: As per a study of Sweden-based Karolinska Institutet, 10 or more years of mobile phone use increases the risk of acoustic neuroma, a tumour on the auditory nerve. no more

Jaipur, October 2 Traditional hookah and chillum are more injurious to health than cigarette, a study has said. The study underlines that the old mode of smoking is much more toxic than cigarette smoke as carbon monoxide (CO) level is higher in it, the study conducted by a group of pulmonary doctors of the SMS Hospital Medical College and the Asthma Bhawan here said.

Surge In Import Of

The dossiers submitted by Mahyco in support of their application for commercialisation of genetically modified (GM) Bt brinjal raise serious concerns. Bt brinjal has been modified to produce an unknown chimeric insecticide toxin containing Cry1Ab and Cry1Ac modified sequences.

New Delhi: The Supreme Court on Thursday tried to strike a balance between the apprehended side-effects of genetically modified seeds and foodgrains and the highincidence of hunger and poverty in India.