Saving the World Bank

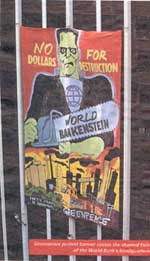

ACTIVISTS around the globe stole the thunder from the World Bank"s (WB) jj4st-concluded 50th birthday, insisting, "50 Years Is Enough". In making their case, protesters were able to point to a seemingly endless list of World Bank created, catalysed or assisted catastrophes: massive relocation schemes in Indonesia that damage rainforest ecosystems and impoveish tens of thousands, failed dams in Kenya and road-building projects in Brazil that accelerate forest destruction, to name just a few.

ACTIVISTS around the globe stole the thunder from the World Bank"s (WB) jj4st-concluded 50th birthday, insisting, "50 Years Is Enough". In making their case, protesters were able to point to a seemingly endless list of World Bank created, catalysed or assisted catastrophes: massive relocation schemes in Indonesia that damage rainforest ecosystems and impoveish tens of thousands, failed dams in Kenya and road-building projects in Brazil that accelerate forest destruction, to name just a few.

Most damning are internal WB studies that reveal the institution"s failure on its own terms, by its very own yardstick. A 1992 internal review (the Wapenhans Report) revealed that the Bank"s own staff rate more than 1/3rd of the projects they undertake as utter failures. It confessed that the deterioration of the Bank"s loan portfolio was "steady and pervasive." Another 1992 report, the Morse Commission"s review of the Sardar Sarovar dam project, condemned one of the largest Bank projects as beset by incompetence, negligence and institutionalised deception - and speci Ired that "the problems besetting the Sardar Sarovar project arf more the rule than the exception to resettlement operations sopported by the Bank in India".

Yet another 1992 internal study concluded that the Bank"s forays into macroeconomic planning in Africa had been a dystopic flop, with less than 20 per cent of its structural adjustment technical assistance loans to theAontinent substantially effective.

Under siege as never before, officials of the world"s most important development usurer say that they are committed to change. "What we are trying to do," explains Armeane Choksi, the WBS vice-president for human resources development and operations policy, is, "change the culture of this institution." The Bank *adopted a "visioning document" called Learning from the Past, Embracing the Future which purports to address the legitimate criticisms leveled at the Bank. It also enacted a "Next Steps" action plan to follow up on the Wapenhans report.

But perhaps no step was more introvertive, despairing and of indisputable importance than the Bank"s creation of an Inspection Panel, an independent appeals body designed to investigate claims filed by people directly harmed by the Bank"s projects. The Inspection Panel holds out the possibility of providing an independent and legitimate mechanism to ensure Bank accountability to its own policies and procedures, many of them warped by political and economic exigencies.

The first claim filed with the Inspection Panel was in October 1994 by members of the Arun Concerned Group (ACG), a Nepalese coalition of non-governmental organisations, on behalf of themselves and 2 anonymous claimants. Their claim challenged the procedures by which the WB had helped design, fund and implement the us $1.2 billion Arun iii Hydroelectric Project, a gigantic dam scheme proposed for the pristine Arun river valley. The project envisions a towering 68 m tall and 155 m long dam with a 400 megawatt (mw) generating station.

The project will displace about 2,700 families; the hill route it will take has already displaced 1,600 families, according to the Panel report. More far-reaching would be the effect of 10,000 rough-and-tough road construction workers, their families and the merciless cash culture on the lives of the valley"s 450,000 indigenous people.

The ACG pamphlet, Arun iii. An introduction and Issues of Concern, says: "This project can only be beneficial to the country when we can sell the electricity produced to the northern parts of India." Only a 50 mw deal is now in place, and a far more expansive deal will be needed to make the project viable. One of the ACG"S complaints is that it is too risky for Nepal to go ahead with the project when it has not yet secured such an agreement with India.

Arun ut is dubiously unique in that the estimated cost of the project is larger than Nepal"s annual national budget. The enormous pricetag has prompted fears that a commitment to the dam will "crowd out" public investments in other desperately needed areas such as education, nutrition, health, and even infrastructural needs like transportation.

The ACG and other critics also contend that a series of smaller dams would be more cost-efficient; they would help develop local engineering and construction skills rather than line the pockets of foreign contractors; they would provide decentralised sources of electricity - meaning that local people could gain access to electricity without connecting to the national grid; small dams would do Ar less damage to the environment; and they would avoid the corpulent Arun iii"s sitting on and asphyxiating indigenous cultures.

The case against Arun iii, and for an alternative approach, is so strong that it has generated a frisson of controversy within the Bank itself. Martin Karcher, a division chief in -the Bank"s South Asian Country Department, quit his job in opposition to the Bank"s continued support to the project. In a September 1994 interview with the Washington DC-based Environmental Defence Fund, Karcher echoed the central criticisms of the ACG. "The government and the donors need to consider alternative investment programmes and a more balanced programme of development, which would generate more productive employment, particularly among the poor," he said. "Large investments in the power sector are liable to crowd out investments in the social sectors."

The Panel"s labour pains

The World Bank"s governing board of executive directors, comprising representatives of the shareholder countries - some of them clearly miffed - which contribute the capital the Bank lends, authorised the formation of the Inspection Panel in September 1993. By April 1994, the body was in action.

Even among the executive board, support for the Panel was tepid, although some members were strong backers. The board established the Panel as an independent body, entirely separate from the Bank"s management. The founding resolu tion stipulates that the Panel must consist of 3 members from different countries, nominated by the Bank president and appointed by the executive directors for 5-year terms.

The executive board gave the Panel a curiously nonspecific mandate to conduct investigations of Bank projects, but made very clear the limits of the Panel"s powers:

• The Panel can investigate issues only in response to filed complaints.

• The Panel can only review the Bank"s adherence to its own policies; the Panel cannot pass judgement on the merits of Bank projects on their own terms or formulate Bank policy.

• The Panel can only make recommendations to the executive directors; it has no direct power to change Bank policy.

Once the Panel receives a complaint, it asks the Bank management to issue a detailed reply. After reviewing the management response, the Panel may recommend to the board that a ftill-fledged investigation be undertaken. It can only proceed to undertake a full-fledged investigation - involving a thorough review of internal Bank documents as well as missions to the project sites to meet affected parties and examine the after receiving authorisa- project"s terrain tion from the board.

Given the structural limitations of the Panel, the novel nature of its mission and the inertia of the Bank"s "big-project, alwayslend" culture, the appointment of strong and X, independent- minded people to serve as investigators was a prerequisite for the Panel to be successful. Providing information was the key function in the Ins ection Panel"s process, given the newness of the Panel and the uncertainty of how it would work and, more importantly, given the paranoid secrecy of the Bank staff and management.

The Panel"s first case began with a sear- ing indictment of the Bank"s performance in the Arun III case. In a 102-page complaint filed by the ACG, the complaint alleges that the Bank violated its own policy in 5 areas:

• The Bank failed to consider the risks involved and alternatives td the Arun III dam until the project was too far underway.

• The Bank"s failure to release key factual technical informa- tion in a timely fashion precluded local debate about the project and participation in its design.

• The Bank failed to assess the environmental impact of the Arun project.

• The Bank violated its resettlement policies as families forced to move by the project were undercompensated and locals did not directly benefit from the project.

• The project would harm the indigenous residents of the Arun valley.

Round 1: Victory for the Arun Concerned Group

On December 16, 1994, after reviewing the ACG complaint and the Bank"s response, the Panel submitted a 21 -page report which listed the specific issues raised by the complaint, the Bank management"s response, and the Panel"s assessment. On virtually every issue, the Panel sided with the Arun Concerned Group (ACG). Among its specific preliminary findings:

• "If a less restrictive assessment, including a wider range of hydro reipurces, could be undertaken, it would result in expanding the number of economically and environmentally acceptable options."

• "The lack of a long-term power sales agreement with India poses a potential long-term risk to the project."

• "A realistic comparison of risks associated with the proposed project and its alternatives could not have been carried out."

• "The large fiscal demands of Arun III may contribute to the risk that policies on poverty cannot be implemented,"

• "The potential of direct, serious long-term damage (to the environment) is significant."

• "The Panel is concerned about the serious problem of enforcing release of information in borrowing countries."

• After the project planners switched plans for an access road route, those displaced for the abandoned route "appear to have been forgotten."

• There appears to have been "a serious violation of the resettlement policies of the International Development Association (IDA)", the arm of the WB funding the Arun project.

Round 11: "A limited victory"

With the release of the Panel"s December 16, 1994, report, the Nepalese activists had won a tremendous initial victory. But the Panel"s report was only the first step in a long process. The next move rested with the 6oard of executive directors. On February 2, 1995, the board rendered the second verdict in the case: the Inspection Panel cotild proceed with the case, but it could only investigate the i8sues of Bank compliance with its environmental, indigenous "leople and resettlement policies. The Board refused to author@$e an Inspection Panel review of the Bank"s consideration of alternatives to the project.

The refusal was a major setback, since in many ways it was the core of the ACG complaint. Paul Mitchell of the Bank"s public relations office says 4hat the board essentially only authorised the Panel to look at a single issue - the route of the access road to the dam. He says the indigenous people problem "is moot, because the government of Nepal says there are no indigenous people in the country, or that everyone is".

The executive directors" overall response to the Panel"s initial work was lukewarm. Eveline Herfkens, executive director from the Netherlands and a strong early proponent of the Panel, called the Panel"s preliminary report on the Arun project "a good first step," but cautioned that the Panel "should not make statements that are not substantiated". Despite Herfkens" criticisms, she supported giving authorisation to the Panel to undertake a hill-fledged investigation.

The United States and the Netherlands are leading supporters of the Panel in the Arun case, and have generally been the strongest promoters of the Panel"s independence, say Bank watchers. Some legislators of the US"s right wing segment are even ready to close the Bank and the International Monetary Fund, while others want to either deflate Or reform the institutions.

The European reaction to the Panel is mixed. France reportedly opposed the Panel"s handling of the Arun case, and Italy was critical of the reach of the Panel"s report. Germany has planned to lend nearly us $125 million to Nepal as a co-financier of the Arun project, and was therefore a likely opponent of Panel"s actions. But Inspection Panel chairperson Ernst-Gfinther Broder, himself a German, has successfully neutralised the German advocacy of the project.

Japan had also planned to co-finance the project through a us $163.3 million loan from its Overseas Economic Cooperation Fund. But it rudely surprised the Bank in July 1994 by announcing that it would not contribute funds to Arun iii until it had completed its own assessment of the project. Meanwhile Japanese NGOs are also planning to launch a major Ar"un-review campaign.

The South itself has been cleaved on the Panel. Lori Udall, attorney with the International Rivers Network, who serves as the Washington Dc representative of the ACG, contrasts the situation to the Sardar Sarovar case, where the South"s representatives, in the name of protect- ing national sovereignty, presented a united front against criticism of the social and environmental effects of a major dam.

Unexplored alternatives

The executive directors" response to 2 fundamental substantive issues raised by the Arun case -the propriety of the Panel"s examination of alternatives and the Panel"s jurisdiction -will also serve to erode the Panel"s power. Understanding the way the alternatives issue played out is tricky business, but critical to an analysis of where the Panel may be heading.

Herfkens, one of the executive directors strongly opposed to the Panel"s investigation of the alternatives issue, says that it "was never part of what the Inspection Panel was supposed to be about -it does not have 9 the expertise". The board, she says, is fully equipped on its own to assess whether alternatives have been sufficiently fears that a commitment to considered.

In the Arun case, because of areas such as education the ACG"S central claim that sounder, lower-cost alternatives were available, precluding the Panel from considering unexplored options may have a significant effect on the ultimate decision on the case.

Still, there may be prospects for a backdoor consideration of alternatives. As Eduardo Abbott, executive secretary to the Panel, notes, "There is some room to look at alternatives in the environmental and social assessment" review the Panel will undertake. In other words, one, element of a sound environmental assessment is considering whether there are alternative ways of doing things that are less environmentally threatening.

The second issue emerging from the Arun case, which may have negative lasting repercussions on the Panel"s power, is the question of who is eligible to file claims. The executive directors" resolution establishing the Panel stipulated that the complainant0must meet 3 criteria: they must live in the borrower country, they must be "directly affected" by the project and they must be a group larger than an individual.

What"s right?

The residency requirement means that Northern NGOS cannot file claims about projects abroad and cannot even serve as representatives for legitimate complainants except in exceptional circumstances and with the board"s approval. The practical effect of their exclusion from direct involvement will be to limit the number of cases brought to the Panel.

However, it is the other 2 standing criteria that were in issue in the Arun case. The 2 anonymous Arun valley complainants filed the claims on behalf of themselves. Thus they each arguably did not meet the requirement of representing more than an individual. The complainants contended that the massive size of the Arun project relative to the national economy meant that every citizen of Nepal would be directly affected; a contrary view would be that they were not directly and physically affected by the actual project itself.

Panel chairperson Broder insists the Panel applied its standing rules properly in the Arun case. The complainants are eligible, is our conviction, he says.

In a January 3, 1995, memorandum to the board, Ibrahim Shihata, World Bank senior counsel, argued that it is not enough for multiple individuals to submit complaints; they must represent a community of interests. And the requirement that the complainants be "directly" affected by the Bank"s project "is not flexible", he wrote. The broader policy concern is that too many, arguably frivolous, cases will be filed if strict standing rules are not followed - and that they will be filed by Northern NGOS. The Panel "is not intended to be a window for American based NGOS", Herfkens says.

Noting that only I claim has been filed with the Panel in its first year in existence, Broder counters, "NGOs have shown a very responsible attitude in not flooding us with requests." David Hunter, senior attorney with the Washington-based Center for International Environmental Law, says that there is no reason for the Panel to ignore legitimate cases just because technicalities are not followed. Combined with another jurisdictional issue - a requirement that complainants must have previously notified Bank staff of their concerns and not received a satisfactory response - strict standing "could completely narrow the focus of the Panel", he says.

Hunter notes that national groups in capital cities are the only Southern NGOS likely to have lodged formal complaints with the Bank. But these groups are not likely to be "directly affected" by Bank projects. Besides, "If a family in a village cannot piggyback on a national group working on an issue," Hunter says, then it may be that neither the family nor the national group will be able to file complaints.

Sinister influence

The Arun case also raises serious questions whether the management is determined to subvert the Panel. jean-Francois Bauer, division chief in the Bank"s country division, which includes Nepal, and Argun Ceyhan, task manager for the Arun project, both declined to comment to Down To Earth on the Arun project or the Inspection Panel, referring instead all questions to the Bank"s public relations office.

The public relations office was not much more forthcoming. "Anything that can add quality to our projects is welcome," says Paul Mitchell, but he declines to comment further on the Panel or its performance in the Arun case. Knowledgeable sources report that the Bank management has tried to sour the executive directors on the Panel, and has exerted improper influence over them.

They say that Joe Wood, the Bank"s vice-president for South Asia, defended the Arun project at an executive board meeting shortly after the Panel issued its December report, and misrepresented what the Panel found.

Mitchell denies that the Bank management sought to improperly influence the board. Regarding what he views as basically a board endorsement of the Bank"s performance in the Arun project, he says, "The facts must "have spoken for themselves." Herfkens too denies that the Bank was unduly influenced by the management in any way. But Eduardo Abbott - while not claiming knowledge of any specific incidents of improper Bank influence - acknowledges that "there is no denying they have better access" than the complainants.

A second problem exhibited in the handling of the Arun complaint was dark secrecy. The Bank staff s response to the ACG complaint was kept confidential till February, when the executive board voted on the Panel"s preliminary recommendation. Udall compares the situation to a law suit in which the defendant is able to keep his response to the plaintiff"s claim secret, thus preventing the plaintiff from responding to the defendant"s argurners. Mitchell claims that the refusal to release the Bank"s response to the complaint was in keeping with the guidelines established by the executive directors. According to Broder, the transparency problems are attributable to the Bank"s inexperience in operating openly.

Autonomy or bust

The Board decision to narrow the scope of the Panel"s full investigation revealed a final shortcoming in the Panel process: the Panel"s dependence on the board for authorisation to proceed with an investigation.

Froixi the perspective of parties affected by Bank projects, this requirement constitutes "a major roadblock". By way of analogy, Udall points to the Operations and Evaluation Department in the Bank, which reviews the efficacy of Bank projects internally; that department is able to pick and choose without the board"s permission, she says, and the Inspection Panel should be given similar autonomy.

Shambling to the future

The Arun case has shown that the Panel will have to overcome a wide array of obstacles if it is to operate as a citizen accessible, independent check on Bank recklessness. Thankfully, the experience so far has by no means been completely disillusioning. The Pai*l has established itself and shown that its inspection process can work. It has asserted its indepenA,ence, and demonstrated a wiltingness to issue far-reaching criti6sms of Bank projects.

b4oreover, the Bank staff - although perhaps grudgingly in man@ cases - has cooperated with the Panel in turning over docAments and information. The other benefit is that the very existence of an independent monitor shining the spotlight on Bank operations - and allowing the public to see what is lit up - appears to be exerting a salutary effect on the Bank staff. Finally, the involvement of the Panel in the case should provide more political space in Nepal for the ACG and other Nepalese NGOs battling the Arun proposal. Whether the Panel will fulfill its promise - whether it can, in any way, save the Bank from itself - remains to be seen. Much more will be evident by mid-1995, when the Panel completes its investigation of the Arun project and the board responds to its final recommendations.

---This story was written by Robert Weissman and researched by Billy Treger.

Related Content

- Rwanda economic update, February 2024: mobilizing domestic savings to boost the private sector in Rwanda

- Assessing the implications of a global net-zero transition for developing Asia: insights from integrated assessment modeling

- The emissions divide: inequity across countries and income classes

- Air pollution and climate change: from co-benefits to coherent policies

- Boosting productivity in Sub-Saharan Africa: policies and institutions to promote efficiency

- Cleaner vehicles and charging infrastructure: greening passenger fleets for sustainable mobility