Non-alternative facts on international fuel prices

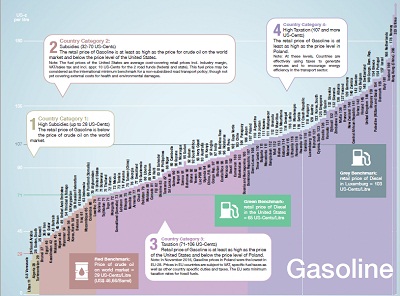

Fuel prices, especially the prices of gasoline and diesel, shape our mobility patterns. Low fuel prices benefit motorized transport and encourage low energy efficiency technologies and wasteful behaviour. On the other hand, countries which price fuels at their real costs of production and furthermore apply fuel taxes can foster the transition towards more sustainable transport modes: they discourage the use of inefficient vehicles and contribute to preventing urban sprawl. Furthermore, if the additional tax revevenues are shifted to alternative modes of transport such as NMT and Public Transport, those can also be made more attractive, resulting in reduced congestion and improved air quality in cities. A sound pricing of fuels, including the application of taxes, provides thus multiple environmental and economic benefits. However, many countries rather than applying taxes, still subsidize gasoline and diesel. In 2015 approximately 145 billion USD were spent on oil subsidies. Changing this status quo is a difficult task as many efforts to reform fuel pricing policies and remove subsidies not only face strong resistance but also suffer from a lack of knowledge and transparency. In order to contribute to knowledge sharing on fuel prices, the GIZ Sustainable Mobility team conducts every two years an International Fuel Prices Survey in cooperation with the GIZ country offices worldwide. It thereby collects the data of gasoline, diesel and other fuel prices in more than 160 countries. The data from 2016 is compiled and analysed in the new publication "Non-alternative facts on international fuel prices 2016", which also provides policy recommendations for a sound fuel pricing policy.

Fuel prices, especially the prices of gasoline and diesel, shape our mobility patterns. Low fuel prices benefit motorized transport and encourage low energy efficiency technologies and wasteful behaviour. On the other hand, countries which price fuels at their real costs of production and furthermore apply fuel taxes can foster the transition towards more sustainable transport modes: they discourage the use of inefficient vehicles and contribute to preventing urban sprawl. Furthermore, if the additional tax revevenues are shifted to alternative modes of transport such as NMT and Public Transport, those can also be made more attractive, resulting in reduced congestion and improved air quality in cities. A sound pricing of fuels, including the application of taxes, provides thus multiple environmental and economic benefits. However, many countries rather than applying taxes, still subsidize gasoline and diesel. In 2015 approximately 145 billion USD were spent on oil subsidies. Changing this status quo is a difficult task as many efforts to reform fuel pricing policies and remove subsidies not only face strong resistance but also suffer from a lack of knowledge and transparency. In order to contribute to knowledge sharing on fuel prices, the GIZ Sustainable Mobility team conducts every two years an International Fuel Prices Survey in cooperation with the GIZ country offices worldwide. It thereby collects the data of gasoline, diesel and other fuel prices in more than 160 countries. The data from 2016 is compiled and analysed in the new publication "Non-alternative facts on international fuel prices 2016", which also provides policy recommendations for a sound fuel pricing policy.