Transitional foreign exchange debt platform: paths to enable foreign currency debt to the rooftop solar sector in India

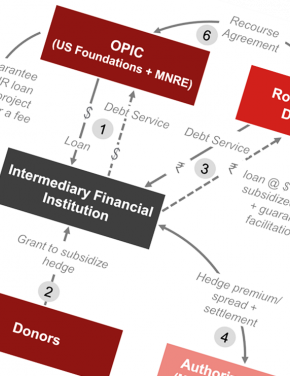

Low access to debt capital remains one of the key barriers to achieving the Indian government’s target of 40GW of rooftop solar installations by 2022. Foreign capital can help bridge the gap in debt availability for rooftop solar, however, foreign currency debt exposes rooftop solar project sponsors to the risk of foreign exchange rate fluctuation. Specifically, rooftop solar sponsors are reluctant to use foreign currency debt due to a variety of factors: International investors are unable to hedge the risk that arises due to currency mismatches when debt is in USD while cashflows are in INR. There are issues related to poor credit quality and credit history of small-scale project developers that preclude these developers from accessing hedging instruments from commercial hedge providers that would otherwise allow them to access foreign debt. India’s managed foreign exchange policy makes currency risk hedging instruments expensive.

Low access to debt capital remains one of the key barriers to achieving the Indian government’s target of 40GW of rooftop solar installations by 2022. Foreign capital can help bridge the gap in debt availability for rooftop solar, however, foreign currency debt exposes rooftop solar project sponsors to the risk of foreign exchange rate fluctuation. Specifically, rooftop solar sponsors are reluctant to use foreign currency debt due to a variety of factors: International investors are unable to hedge the risk that arises due to currency mismatches when debt is in USD while cashflows are in INR. There are issues related to poor credit quality and credit history of small-scale project developers that preclude these developers from accessing hedging instruments from commercial hedge providers that would otherwise allow them to access foreign debt. India’s managed foreign exchange policy makes currency risk hedging instruments expensive.