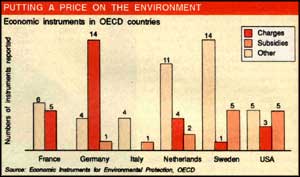

Economic instruments there...

CHARGES: Charges are a "price" polluters must pay for using environmental services. They increase costs of production for polluting industries. Various types of charges are:

CHARGES: Charges are a "price" polluters must pay for using environmental services. They increase costs of production for polluting industries. Various types of charges are:

• Effluent charges are levied based on the quantity and/or quality of effluents discharged into the environment.

• User charges are payments for collective effluent treatment by government bodies.

• Product charges are added to the price of products that, in their manufacturing or consumption stage, are polluting, or products for which a disposal system has been organised.

• Administrative charges are payments for authority services such as control and authorisation fee.

• Tax differentiation is a policy by which taxes are used to bring about favourable prices for environment-friendly products, and vice versa.

SUBSIDIES: A subsidy is a financial incentive for polluters to alter their behaviour. It can also be used to help firms that face problems in complying with environmental standards. Subsidies can be in the form of:

• Grants that are usually non-repayable.

• Soft loans at a low rate of interest.

• Tax allowances that include higher depreciation rates.

DEPOSIT-REFUND SYSTEMS: A surcharge can be levied on the price of potentially polluting products. When pollution is avoided by returning the products or residuals to a collection system, the surcharge is refunded.

MARKET CREATION: Artificial markets can be created where manufacturers can trade their "pollution rights" through:

• Emissions Trading: If a polluter releases less pollution than he is allowed, on the basis of limits fixed collectively for a particular region, he can sell or trade the difference to another firm that discharges more than its limit, thereby creating incentives to switch to less-polluting technologies.

• Market Intervention: Price intervention or ex-ante price guarantees that facilitate the continued existence of a market.

• Liability Insurance: This can be effected by legally establishing the liability of polluters for environmental damages or clean-up costs. Risks may be covered by insurance premiums.

ENFORCEMENT INCENTIVES: Enforcement incentives provide an economic rationale for compliance when non-compliance is a seriously considered decision alternative by companies. These are of two types:

• Non-compliance fees are imposed when polluters do not comply with certain regulations and are based on the profits resulting from the non-compliance.

• Performance Bonds are payments to authorities in expectation of compliance with imposed regulations and refundable when compliance has been achieved.

...and here

India already has a number of financial incentives aimed at promoting renewable energy development and environmental conservation.

renewable energy: Various incentives are extended to industries engaged in the manufacture and utilisation of new and renewable sources of energy. Import of devices such as vacuum solar collectors, concentrating solar collectors, stirling engines, wind-operated electric generators and battery chargers, and filter media required for effluent treatment plants and recovery of biogas from it are exempt from customs duty. Since March 1992, imports of non-conventional energy equipment have been totally exempt from duty. Various state governments allow concessions or exemptions in sales tax on new and renewable energy systems.

Customs duty has been reduced on import of machinery and components required for the manufacture of solar photovoltaic devices. Many relevant items have also been either exempted from excise duties or granted substantial concessions. The Central and state governments extend several subsidies and concessions, including a 100 per cent rate of depreciation, for large-scale utilisation of photovoltaic systems. No industrial licence is necessary for projects that have no foreign investment.

Wind electric generators: Between July 1991 and March 1992, an import duty of 40 per cent was imposed on wind electric generators (WEG) and battery chargers to encourage local production. However, the duty came at a time when a number of wind-farm projects using imported WEG were being considered by private companies. The combined effect of the import duty and rupee devaluation adversely affected the economics of wind-based electricity generation. On the other hand, local assembly and production of wind turbines saw little progress despite the fact that import of a number of components are allowed without duty. The 1992-93 budget removed this duty on WEGs.

Under the industrial policy announced in July 1991, industries engaged in the manufacture of alternative energy systems such as solar, wind and related equipment have been granted automatic approval of foreign technology agreements, including 51 per cent foreign equity. Central subsidies are provided for the utilisation of non-conventional energy systems. The fiscal incentives include tax benefits and accelerated depreciation at the rate of 100 per cent in the year of installation. Upto 80 per cent of the cost of wood gasifiers and stirling engines is borne by the Union Ministry of Non-Conventional Energy Sources and the remaining 20 per cent by the user or the state nodal agency.

The Indian Renewable Energy Development Agency has sanctioned financial assistance to 52 projects worth Rs 24.84 crore, of which international aid accounts for 16.79 crore.

water pollution: Under the Water (Prevention and Control of Pollution) Cess Act, 1977, the state governments used to collect a cess from polluting industries and credit it to the consolidated fund of India. Since 1987-88, however, the Ministry of Environment and Forests collects the money and gives it to the state pollution control boards. The state boards received Rs 6.37 in 1990-91 and Rs 6.30 crore in 1991-92. A similar amount is estimated for 1992-93.

The Water (Prevention and Control of Pollution) Cess (Amendment) Bill, 1991, which among other things provides a rebate to industries for complying with effluent quality standards, has been passed by Parliament. The amended act became effective from January 26, 1992. It enhances the cess rates and incorporates incentives and disincentives based on pollution loads. With effect from April 1, 1992, 75 per cent of the funds will go to the state boards, while 25 per cent will be retained by the Central government to encourage research and development in clean technologies and to assist local bodies set up sewage treatment plants.

According to a 1990 notification, certain pollution control equipment attracts an excise duty of only 5 per cent. An earlier notification, in 1989, reduced to 35 per cent customs tariff on 35 kinds of imported equipment used in pollution control and for safety in chemical industries. Additional duties have also been waived for such equipment.

According to the materials division of the Central Pollution Control Board, pollution-assessing equipment worth a maximum of Rs 3 crore per annum and consumable items worth a maximum of Rs 1 crore per annum can be imported without paying customs duty. Individual items in both categories, however, have a ceiling of Rs 10 lakh and Rs 1 lakh each per annum. To import goods above these limits, permission is necessary from the Directorate General of Trade and Development.

deforestation: India is encouraging the import of wood and wood pulp to conserve its forest resources. Wood and wood articles are charged a concessional import duty of 10 per cent. Processed wood is charged 20 per cent duty, and mechanically processed wood 45 per cent.

Rayon grade pulp wood attracts 25 per cent duty. Only 10 per cent duty is charged on wood pulp derived from chemical and mechanical processes. Paper and paper boards are charged an average 40 per cent duty.

Imported newsprint that uses not less than 70 per cent wood pulp is exempt from duty, but other forms of newsprint are charged at the rate of 45 per cent. India imported wood pulp and waste paper worth Rs 454.33 crore during 1990-91.

| WATER CESS: TOO LOW FOR IMPACT? | ||

| Rates of water cess applicable since February 1992 (in paise per kilometre) | ||

| Upper limit | Lower limit | |

| For domestic use | 3 | 2 |

| For use as industrial coolants | 2.25 | 1.50 |

| For use in processes where pollutants are biodegradable | 7 | 4 |

| For use in processes where pollutants are non-biodegradable | 9 | 5 |