Future lies in green tax

future lies in green tax Even after dismantling of direct subsidy on diesel in 1997, Ram Naik, the petroleum minister, admitted that indirect subsidy on diesel had risen to Rs 3 per litre. Inflationary stress on account of diesel price hike is wagged as the most important rational against any proposal to increase diesel prices. While the government hides behind the excuse that an increase in the price of diesel would lead to inflation, economists have a different story to tell. According to noted columnist Prem Shankar Jha, "Increasing the price of diesel by around Rs 4 will increase the rate of inflation by only about 0.5 per cent.' "This is hardly anything. It will not last and will be smoothed over in around six months,' he adds. The myth of inflation is misleading, says Bibek Debroy, director of Delhi-based Rajiv Gandhi Foundation. "If there is a price increase, it will be a one-time shock. But if the price is not rationalised, the deficit will also keep on adding to the inflation rate."

future lies in green tax Even after dismantling of direct subsidy on diesel in 1997, Ram Naik, the petroleum minister, admitted that indirect subsidy on diesel had risen to Rs 3 per litre. Inflationary stress on account of diesel price hike is wagged as the most important rational against any proposal to increase diesel prices. While the government hides behind the excuse that an increase in the price of diesel would lead to inflation, economists have a different story to tell. According to noted columnist Prem Shankar Jha, "Increasing the price of diesel by around Rs 4 will increase the rate of inflation by only about 0.5 per cent.' "This is hardly anything. It will not last and will be smoothed over in around six months,' he adds. The myth of inflation is misleading, says Bibek Debroy, director of Delhi-based Rajiv Gandhi Foundation. "If there is a price increase, it will be a one-time shock. But if the price is not rationalised, the deficit will also keep on adding to the inflation rate."

Emphasising on the importance of green taxes as an important source of revenue for undertaking pollution abatement measures, Anil Agarwal, chairperson of the Centre for Science and Environment (cse), says, "An extra rupee charged on each litre of diesel sold (as on 1996-97) can whip up an additional Rs 150 crore that can meet the substantial cost of moving all buses to CNG in Delhi.'

Similarly, while the Supreme Court directives have helped to bring forward the Euro I and Euro II norms, the Indian government has failed to design appropriate fiscal policies to keep the momentum up. The finance ministry only resorts to reducing import duty on catalytic converters and compressed natural gas kits.

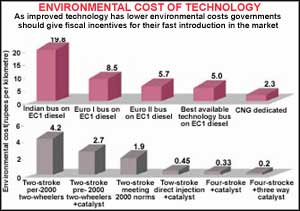

cse has argued in favour of a separate pollution tax, depending on emission levels met by different manufacturers called environmental excise duty (eed). Manufactures should be taxed based on the emission improvements they have made over and above the current standards. If they improve, they get a tax cut. eed is based on the principle that the tax should recover from manufacturers the cost imposed by their vehicles on the environment, and encourage them to produce cleaner products (see graph: Environmental cost of technology). And as manufacturers meet the tighter norms, the government can gradually remove the tax benefits from the lower grades of these norms. cse had presented such a proposal to the then Union finance minister, P Chidambaram, in 1997. He, had initially promised to incorporate it in the Union budget but then failed to deliver.

The government's apathy in framing a proper road pricing policy has encouraged uncontrolled growth of two-wheelers and cars at the cost of mass transit. An Indian car-owner only pays a nominal price for the road he uses for a lifetime only once. This acts as an incentive to increase car usage.

Related Content

- Interconnected disaster risks: Turning over a new leaf (2025 report)

- Uttar Pradesh Pollution Control Board report regarding unscientific dumping of solid waste in village Fatehpur Bujurg, district Bulandshahr, Uttar Pradesh, 01/06/2023

- Uncertainty and opportunity: the status of forest carbon rights and governance frameworks in over half of the world’s tropical forests

- Order of the National Green Tribunal regarding cleaning of drains, Haryana, 17/03/2016

- Global Consumption Trends Break New Records

- Global Consumption Trends Break New Records