Grim reminder

A fleeting reappearance of plague exposes India's lack of preparedness

A fleeting reappearance of plague exposes India's lack of preparedness

With rising awareness regarding the hazards of incinerating waste, a lot of proposals for incinerators have been ruled out in the West and the search for a viable alternative is on

To save their forests from degradation, villagers will have to deal tactfully with the host of conflicts that sprout out of the field of good intentions

A cloud o criticism forms over the proposal to set up a high power nuclear plant at Kudangulam in Tamil Nadu

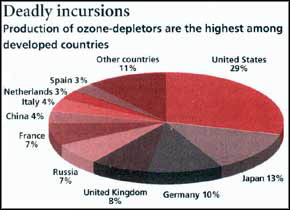

As concern for the ozone layer mounts, two more chemicals have been found to have a degenerating effect on the protective shield

The discovery of a generation old plant extract used by Onges in The Andarnans has patent hungry profiteers jostling their way down There The question is, whether the custodians of the secret stand to gain anything at all

Buhanpur Municipal Corporation in Madhya Pradesh revives a unique underground water system of the 17th century, Khooni bhandara, to solve the city's water scarcity problems

A proposed power generation project in Laos has become the target of environmentalists ire

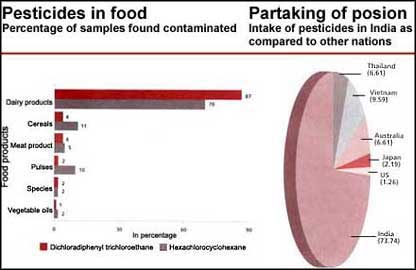

Despite a government ban on use of some common pesticides in agriculture, our food continues to be contaminated. The there is no alternative factor, ie the absence of more acceptable substitutes, the cost factor and the easy availability of the pesticide

Encroachments by the poor and the rich alike are proving to be the ridge's bane. The malady is monumental, and the court's healing touch has provided incomplete relief at best

<div> <div class="viewer">On June 12th, <a target="_blank" title="//articles.timesofindia.indiatimes.com/2011-06-12/india/29649545_1_land-acquisition-forest-clearance-environmental-clearance" href="http://articles.timesofindia.indiatimes.com/2011-06-12/india/29649545_1_land-acquisition-forest-clearance-environmental-clearance" class="externalLink">Environment Minister Jairam Ramesh made national

Laos' forests may go for a six following the implementation of two forest aid packages

A recent, innocuous check-and-tally exercise by the Delhi administration unearthed a giant racket diverting to the transport sector heavily-subsidised kerosene meant for domestic consumption

Initially born as the good samaritan environmentalist's brainchild, recycling now smacks of a lot of hard cash

Even though funds for the Superconducting Super Collider have dried up, particle physicists are determined to prove their theory of, well, everything

The global godfather of nations The United Nations Organization is bankrupt and counting its pennies

After the Thapar Dupont plant was driven out of Goa, and it found a refuge in Tamil Nadu, a ho,n,t's nest has again been stirred up

GREEN POWER: The greening of the Rs 300 crore Venkatesbwara Hatcheries (VH) has begun. The company's first windfarm with four 225 kw mills started whirring in power from September. This windfarm

WHEN Meghnaad, brother of King Ravana of Lanka, grievously injured Lakshman, brother of Lord Rama, Hanuman was sent to Gandhamardan Parvat to fetch the Mritasanjeevani Sudha, a life-saving herb.

A proposed bridge to link Vypeen island with the mainland spurs controversies