Energy aplenty

The recycling option has once again shown that wastes like bagasse and wheat straw can be profitably used to generate energy, which could in all probability, ease the continuing energy shortage

The recycling option has once again shown that wastes like bagasse and wheat straw can be profitably used to generate energy, which could in all probability, ease the continuing energy shortage

The widespread and diverse use of gobar in Indian society stands up to every principle of good environmentalism. Cowdung is a waste product. Yet, instead of being looked down upon, it is highly respected

Pakistan lacks a comprehensive energy efficiency development road map and investment programme and international experience indicates that the effective implementation and incorporation of energy efficiency into the policy mainstream requires concerted, long-term action and commitment, said Asian Development Bank report. In a project update report on 'Preparing the Sustainable Energy Efficiency Development Programme for Pakistan', the ADB emphasised the need for a comprehensive policy and regulatory framework; energy price and utility rate-setting reforms and incentives; a strong equipment standards, certification, and testing regime; complementary alternative and renewable energy programmes; and easy, widespread access to energy efficiency information, financing, products, and services by all categories and levels of energy market players and end users. According to ADB project study, the energy efficiency assessment conducted under ADB's Energy Efficiency Initiative determined that Pakistan has a large and untapped energy efficiency market. It identifies several energy efficiency improvement opportunities in gas distribution (supply side) and in the government and residential sectors (demand side) that can be tapped into. These opportunities may be explored without extensive precursor preparations, detailed policy design, or framework development, achieving immediate energy savings and deferring additional supply requirements. Further refinement and expansion of such options could result in a portfolio of immediate, bankable energy efficiency investment options for Pakistan, which the government and ADB may consider. According to report, the government and domestic consumers consume more than 60 percent of Pakistan's energy. The public sector is the most inefficient consumer, and the government is looking for more efficient utilisation and conservation measures. The government is eager to procure and adopt energy efficient technology in its operations, including the use of efficient lighting and heating and cooling systems in existing and new buildings, and introduction of energy-efficient building codes. The domestic sector currently uses 45 percent of the power supply. The most effective way to expedite the use of efficient compact fluorescent lamps by domestic consumers is to inject a large volume of such lamps into the market at a low price. This approach has been successful in several countries, where it has immediately reduced customers' monthly power bills. Preliminary analysis suggests that the introduction of 15 million high-quality compact fluorescent lamps into Pakistan's domestic market would save customers $78 million over the lifetime of those bulbs (approximately 2 years). This money could be used more productively in the economy. In addition, 880 MW of power demand would be avoided. The cost of such additional new generation capacity would be $1.15 billion (at $1.3 million per MW), ADB report disclosed. ADB report further pointed out that Pakistan's gas distribution system is ageing and is suffering from high technical losses (25-30 percent in some areas compared to industry standard 5 percent) that could be eliminated by replacing medium and low pressure pipes with more efficient, corrosion-free pipes. Natural gas accounted for half (43 billion cubic meters) of Pakistan's primary energy supply in 2006. A more efficient gas distribution system would result in significant national savings (up to $580 million per year) and increased use of cleaner fuel by more domestic, industrial, and commercial consumers, ADB report mentioned. It said that Electricity consumption, projected to grow an average of 8 percent per annum until 2015 (although recent experience suggests much higher demand growth), will similarly require large power generation capacity additions. Higher energy demand and imports will also require massive investments in associated port terminals, storage facilities, refining capacity, pipeline and transmission networks, and surface fuel transport infrastructure. During 2001-2006, ADB report stated that primary energy supply increased 5.4 percent per year. Meanwhile, consumption of electricity rose at an average annual rate of 6.8 percent, natural gas by 10.4 percent, liquefied petroleum gas by 17.6 percent, and coal by 22.8 percent. Electricity use, in particular, is growing robustly across all sectors-industry, agriculture, domestic, and commercial-recording a 10.2 percent overall jump in 2005-2006, while generation increases lagged at 9.3 percent during the same period. Copyright Business Recorder, 2008

While we all get ready for elections, fiscal rectitude will be a priority for the next government. The curtains have finally come down. The Budget has provided a clear indication of things to come. In a year when 11 states will go for elections and the sword of Damocles for the general elections hanging, a populist fiscal stance is only to be expected. Unfortunately, a populist Budget never fully appeases anyone. Those who get the sops want more and those who do not get them get more upset. This Budget attempts to target the benefits to sections of farmers and urban middle class and when the Pay Commission report is submitted, to the government employees. It is yet to be seen whether the largesse will translate into votes, but surely, these measures will impact for several more years. The Economic Survey was candid about the need for austerity in the prevailing environment, but the Budget does not seem to care. The Budget for 2008-09 has been formulated in the background of moderating growth, a difficult international environment, unimpressive agricultural performance, rising world oil prices, surging capital flows and continued infrastructure bottlenecks. Austere fiscal policy was required not only to provide a counter-cyclical stance but also to keep interest rates low and manage capital inflows better. Acceleration in growth required significant augmenting infrastructure investment. Rationalising subsidies and increase in investment were necessary to accelerate the agricultural growth rate to 4 per cent. It was also hoped that the finance minister would initiate reforms in the excise tax regime to move towards a goods and services tax (GST). To be fair, higher allocations have been made in the Budget for some of the infrastructure sectors though capital expenditure as a ratio of GDP shows a decline. The energy sector's allocation is 30 per cent higher, the roads and transport sector's 22 per cent higher, and communication sector's 32 per cent higher. There are substantially higher allocations to the six components of the Bharat Nirman Programme, which are in the nature of improving connectivity and rural infrastructure. The total plan expenditure in the Union Budget shows an increase of 17.3 per cent over the revised estimate for 2007-08, though this is just about one-half of the level in 2004-05. However, plan capital expenditure shows an increase of just 5.3 per cent, and at 0.6 per cent of GDP this is worrisome. Thus, there has been a significant increase in plan expenditure, but not for creating infrastructure but for various schemes, most of which are in the states' domain. The funds for these programmes are transferred directly to the third level of government or other implementing agencies because the central government wants to claim ownership and clearly, in many places accountability and delivery systems have yet to be put in place. Economists judge the Budget on the basis of its likely macroeconomic impact and policy signals it gives. In the context of surge in capital flows, it was necessary to keep the interest rates low and allow the RBI to undertake market stabilisation to ensure relatively stable exchange rates at least in the short term. That called for containing the fiscal deficit at even lower than the target set under the FRBM Act. For 2007-08, thanks to the buoyant revenues from direct taxes, it was possible to overreach the target, though some expenditure liabilities, particularly on subsidies, have not been fully taken account of. The revenue deficit for 2008-09 relative to GDP is estimated at 1 per cent and the fiscal deficit at 2.5 per cent. Indeed, although phasing out the revenue deficit is mandated in the FRBM Act, it was unrealistic to expect reduction in the deficit by 1.5 percentage points in one year. Budgets are like fashion girls on the ramp; what they hide raises more curiosity than what they reveal. However, most observers have been quick to point out that the fiscal deficit is clearly an underestimate for it does not take account of some important liabilities. First, the Budget estimates do not include the impact of implementing the Sixth Pay Commission. It may be recalled that it was the pay revision in 1997-98 that led to an era of high fiscal imbalances and this alone could add to the fiscal deficit by about half a percentage point of GDP. The second important omission is provision for loan waiver. This is estimated to cost Rs 60,000 crore and or a little over 1 per cent of GDP. That is not all. Despite claims to transparency, the subsidy numbers clearly look under-budgeted. In the case of fertilisers, for example, the Budget estimate for 2008-09 at Rs 30,986 crore is close to the revised estimate for 2007-08 (Rs 30,501 crore). Of course, this does not take account of the Rs 7,500 crore bonds given to fertiliser companies. That is not all. The subsidy accruing to fertiliser companies based on the estimated sale of fertiliser would not be less than Rs 60,000 crore in 2007-08 and to that extent the deficit numbers for 2007-08 are suspect. This is the problem with a Budget prepared on the basis of cash and not accrual accounting. Finally, it is not clear how the finance minister will find an additional Rs 10,000 crore for Gross Budgetary Support for the plan when revenues are estimated to grow at 17.5 per cent and direct taxes at close to 20 per cent even after taking into account the increase in the exemption limit in personal income tax and reduction in excise duties. By this reckoning, the fiscal deficit and off budget liabilities should at least be higher by another 2 per cent of GDP. On changes in tax policy, reduction in the CENVAT rate to 14 per cent, increase in the threshold for service tax and reduction in the Central Sales Tax would help in eventually introducing GST. But the measures stop there. This was the opportunity to extend the base of service tax to all services and universalise input tax credit to convert the CENVAT into a manufacturing stage GST. The tinkering in excise rates has continued and this does not make sense. The policy makers are still to understand that crowding the tax policy with too many objectives only adds to administrative complexity and creates pressure groups. On the whole, difficult days are ahead and while we all get ready for elections, fiscal rectitude will be a priority for the next government, whoever comes to power!

The automobile industry can breathe easy with the Supreme Court lifting its earlier restrictions on the sale of cars; plea for extending deadline on emission norms rejected

Harnessing solar energy has been a long-standing scientific goal. The latest approach employs chemicals that, like the leaves of a tree, soak up solar energy for use later

Delving into the underworld of matter, scientists are coming up with miniaturised miracles

The challenge is how to isolate gross polluters from the vehicle fleet and send them back to the manufacturers

While the apex court has brought to Patancheru's effluent riddled land some relief in the forms of compensation and drinking water, it has not yet remarked on the government agencies' non functioning complacence

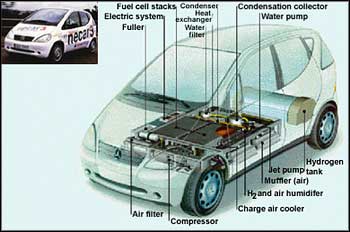

They may not seem like much today, but only a fool will undermine the potential of fuel cells

Acquiring prime forest land near town and highway and then selling it at an exorbitant price has become routine in the state

on april 13, 2007, residents of Achen, a locality in Srinagar, and the municipal authorities agreed that three new dumpsites should be set up in three zones of the city, to supplement the

The environment in which an embryo develops influences gene expression and some acquired traits can be inherited

Scientists in New Zealand have developed a low cost technology that can clean contaminated soil

Rampant illegal iron ore mining in Karnataka s Bellary district

Livelihoods of fisherfolk is at stake as the Mundra special economic zone (sez) on the northern shore of the Gulf of Kutch gets underway. Potentially the largest sez in the country, it covers 28 km

<table width="534px" height="196" border="0" cellspacing="0" cellpadding="0"> <tr> <td width="41%"><a href="cover.asp?foldername=20070315&filename=news&sid=34&page=2&sec_id=9&p=2"><img src="../files/images/20070315/20.JPG" alt="garbage" width="293" height="196" hspace="0" vspace="0" border="0" /></a></td> <td width="1%"> </td> <td width="58%" bgcolor="000

<img src="../files/images/20070930/26.jpg" align="left"/>On the night of October 1, 1998, when Salman Khan went hunting blackbucks, he was explicitly warned not to do so in the Bishnoi area because only a few have managed to get away from them. Yet Khan and his co-stars Saif Ali Khan, Tabu, Sonali Bendre and Neelam, along with local contacts, went ahead and shot two blackbucks.

Plans have to include all people Mukund Gauns who owns about 4 ha of land in Caranzalem in Taleigao, used to grow paddy. "I grow vegetables now, I cannot cultivate paddy anymore because there

In any democratic country, environmental concerns can get integrated with developmental programmes only if the leader is sensitive to them